WAKISO Green Light Forum Staff and Community SACCO

Vision: To be a leading SACCO that empowers its members socially and economically to create equal opportunities for future sustainable development and bonding through saving and credit.

OUR MISSION

Support SACCO members through timely financial services to carry out small and medium businesses sustainably in central and mid-west Uganda.

OUR GOAL

Inculcating a saving and lending culture among the SACCO members that will enable them diversify their income source for improved livelihoods.

ABOUT THE SACCO

WAKISO Greenlight Forum SACCO

WAKISO Green Light Forum Staff and Community SACCO is a joint financial venture started by partner members of Green Light Forum -Uganda. These include 5 non-government organizations, 2 vocations and 7 schools who immerged with an idea of saving and credit in 2020 after the outbreak of the COVID-19 pandemic. This was an eye opener to members of how to meet their economic and social needs.

It was established in May, 2021 and its’ registered under the Ministry of Trade, Industry and Cooperatives. Registration Certificate Number is P. 19264. Its offices are stationed in Seguku opposite St. Peters Secondary School off Entebbe road.

Organization structure

The SACCO is governed by a Board of Directors/ Executive Committee Members constituted by 14 members appointed from the organizations and schools under Green Light Forum Uganda and these are elected by the AGM, the last AGM was held on 6 of August 2021. These further represent the different committees as it is shown in the table below. Under the BOD is the Chairperson who manages the four departments/committees and these include: Supervisory committee headed by Mr. Kitungulu John Baptist who is in charge of supervising the operations of the SACCO; Procurement committee headed by Mr. Kirumira Mutwalibi and it’s responsible for the purchase and negotiations; Loans committee headed by the Treasurer who is in charge of the Loan portfolio management, though it’s unfortunate that Mr. Kakinda Conrad left his position and its yet to be occupied; and the Management committee which headed by the Manager.

The SACCO has one employee i.e. the manager who is assisted by two volunteers i.e. the accountant (Namuli Joyce) from YARD and the cashier (Nabaggala Stellah) from St. Peters Primary School. Each of these two come at the office once a week, then every after two weeks the management committee members meet on Saturday to make sure that all transactions carried out throughout that time are recorded in the right manner and all books of accounts balance accordingly

Funding

The SACCO in March 2023 received another grant of 7,450,000/= (seven million four hundred fifty thousand shillings) from GLS. However still this grant was to increase on the SACCO capital base, capital expenditure to carry out its operations smoothly basically the new clients to get sustained at least well. And it implies that enabled the SACCO will increase in its loan portfolio.

So far for the past grants from GLS which apparently is totaling Ugx 84,641880 has brought a very fundamental changes to the Wakiso GLF SACCO and to its members as a whole and we still have much hopes that even this grant is going to be of a positive cause to the SACCO.

This new grant of seven million (7 million) has covered salary arrears, allowances, receiving of post machines (min printer), disbursement of loan etc.

So its upon that background that I take this opportunity to thank GLS for the support given to Wakiso GLF SACCO and its members which has yielded much products

Incomes

Membership

According to the past report, the GLS SACCO had 65 fully registered members of whom 28 are male, 23 females and 14 institutions where 43 of the members are active these have both shares and savings at a moment and 16 members who are not fully active but are promising. However, the SACCO has won another three potential clients which implies that GLS SACCO is now having 68 fully registered clients but it has another expectation of 5 clients from Kibirige memorial primary school and 1Kisaakye primary school from Buikwe district who are still fulfilling the requirements of GLS SACCO hopefully before the end April will be fully registered.

To register as a member one was to pay 50,000. As membership fee but it was amended to Ugx 20,000 to easen and simplifies our clients to join the SACCO.

Shares

The SACCO had two categories of shares where Category 1; which has been including institutions, each institution could cost Ugx 100,000 and Category 2; Shares by individuals, each could cost 50,000 Ushs but the SACCO has amended and resorted to all shares be it institution or individual, it’s now uniform to 20,000/= Ushs.

There has have increased from 22,550,000 to 23,500,000/=, 4% increment and we hope members to purchase more shares in the future.

Shares by loan

These are share one has to purchase when he or she is processing a loan,

Note: The GLF SACCO has so far raised 540,000/= from January to March 2023 from shares by loan.

Membership

Our Savings stand at Ugx 21,248,200 since January to march 2023

New product was introduced to the SACCO (JUNIOR SAVINGS ACCT), this is meant for the minors’ i.e pupils in our member schools where Nambeeta primary school and St. Peters primary school have been sensitized about this product and we have received the first savings already from Nambeeta primary school

Loan Portfolio

There is an increase in loan portfolio from Ushs 225,300,000 in December 2022 to Ushs 254,800,000 as at 31 March 2023.

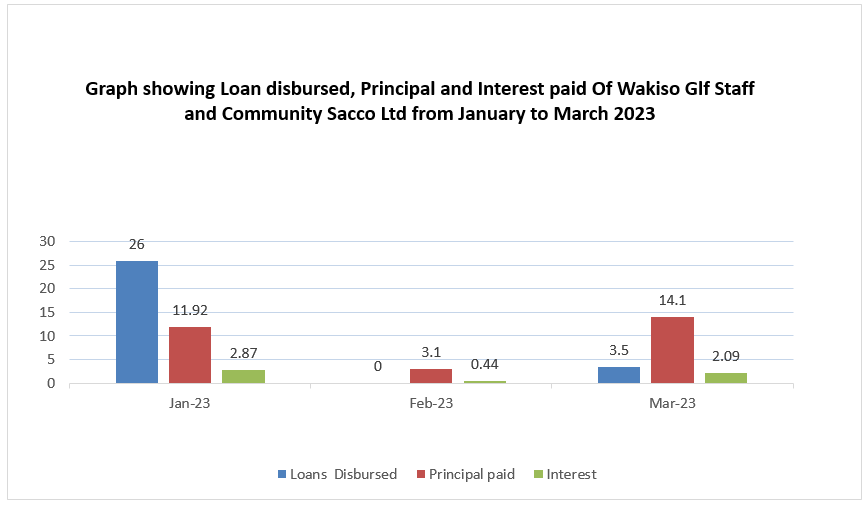

A total amount of 16,135,000 Ugandan shillings has been paid, where Ushs, 14,045,000 as principal and Ushs 2,090,000 as interest. Loan balance stands at Ushs 77,688,000 of which Ushs 67,306,400 is outstanding principal and Ushs 10,382,500 is the outstanding interest. I would like to congratulate everyone as the SACCO, however there has been a tendency of delayed payments which slows down the SACCOs operations and it has come to my notice that GOTCO has totally failed to cooperate with management as her loan worrying.

Below is a graphical showing of the monthly loan disbursement of loans to members from May 2021 to November 2022.

Work shops

The executive committee had capacity building at Garuga meeting about strategic plan development governance, operation system, accountability both external and internal, during this course, new amendments were made for example, membership fees, shares, and new services and products were introduced in order to reach out to clients’ etc.

Challenges

- Delays in completion of loan disbursement for the clients has also still a big challenge to the SACCO.

- Power shortage is still an issue whereby it hasn’t been worked upon to help in running of the SACCO machines, this has delayed the operation and increase in costs because stationary work is still being done from outside.

- Sensitization of new products, however, it has been thought that for sensitization of new products is paramount to all new clients, old, and expected clients to the SACCO but in this past sessions it has not worked to its expected. People have not been sensitized well to new products which we are expecting to advance to this new login.

Way forward

- Bulk deposit to boost saving is t be made three months arrear to qualify for a loan of 3 million plus.

- Regular sensitization to all organizations and schools of the SACCO operates since there are some new products on market. As management we thought that the manager should be visiting all organizations at least once after six months to interact with members directly. We should provide stickers to all organizations showing all the products we offer.

- Encouraging members to save more and should learn from the 2020 pandemic as no one expected that the whole world would shut down for that long.

- Members are called upon to engage in getting more shares this will enable the SACCO to increase its financial base.

- The SACCO is in the process of acquiring a Merchant code from Airtel first, where members can simply make payments from their phones to the SACCO account without going to the Bank or using agents.

- During the last executive meeting the merchant code was discussed and the conclusion was drawn to it for the need of our many client to easily access our products and now its in the process before the end of April 2023

- All committee members should fulfill their respective duties and roles, for the good of the society.

successful stories from some of the members who borrowed from the SACCO

Above is Katongole Lawrence’s house house after roofing it

Katongole Lawrence

Katongole Lawrence is a teacher at St. Peters Primary School and a member of the SACCO. He got a loan of Ugx 3,000,000 (three million shillings) which he used together with the savings he had to purchase a piece of land in Kajjansi, eight months later he was able to settle his loan and acquired another loan of Ugx 3,000,000 (three million shillings) and with this he started constructing a 6 room house. Nether the less he went back to wakiso GLS SACCO and processed Ugx 4,000,000 (four million shillings) which was disbursed to him to roof his house, apartly he is in a need of other Ugx 4,0000,000 (four million shillings) for the completion of his 6 bed room house i.e plastering, installing doors and windows.

“He is much pleasured with GLS SACCO services that has helped him get out of renting, he pray that All mighty God awards the SACCO abundantly “ Katongole Lawrence.